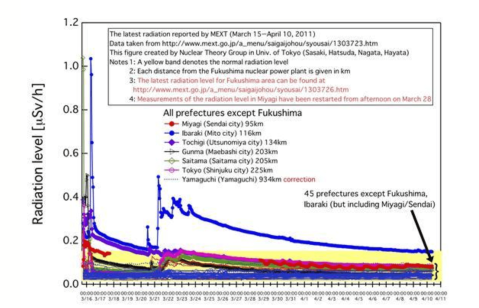

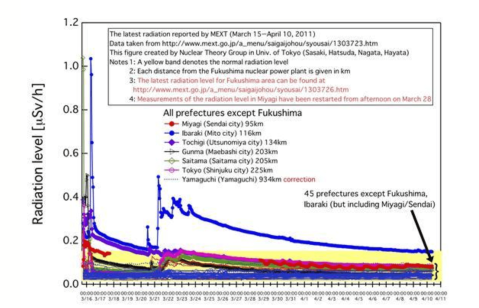

Radiation levels in Japan post-Fukushima

The source for this chart is Ryugo Hayano, Ph.D. Professor Hayano is the Physics Department chair at The University of Tokyo. Click on the chart to view a larger version, with higher resolution. It used to link directly to the Hayano account on one, then another image sharing site, but both are out of business now. (Lack of persistent URLs is a problem everywhere.)

Radiation levels in Japan March 15 to April 10, 2011

I offer my thanks to @hayano and Daniel Garcia. Daniel R. Garcia Ph.D. is a nuclear scientist from France, doing a postdoc at TEPCO, in Fukushima. He was there prior to the earthquake and tsunami. Daniel frequently sends updates as @daniel_garcia_r. He works at the reactor site every day, takes photos, and makes them available via Twitter.

Control board of Fukushima 1 nuclear power plant when all was well

Both Daniel and Professor Hayano are reliable, because they never confuse Becquerel with Sievert with Roentgen. They know radio-isotopes and their half-lives better than nearly anyone. Daniel was needed to assist the press a few weeks ago, when there was confusion between Cesium 137 versus Iodine 137 and again between Iodine 131 versus Uranium 137.

Other locales, other radiation levels

The Radiation Network is an excellent resource for radiation information in the U.S.A. and other parts of the world. It is a network of civilian volunteers using a protocol to report radiation readings, 24 hours a day, 7 days a week. Sensor stations are located throughout the contiguous 48 states, Hawaii, Alaska and Norway. There was one in Northern Japan. Sadly, that sensor went off-line last month.

The Radiation Network is non-profit, all volunteer and headquartered in Arizona. Tim is the public face of the Radiation Network. Using software developed for this purpose, Tim collects and aggregates the real-time data from the sensor stations, then updates the map online with the readings at one-minute intervals. The Radiation Network went online nearly a decade ago, and offers reliable baseline measurements for comparison. This facilitates detection of any incident. The criteria for elevated radiation levels include:

- Rule-out protocol for false positives, e.g. spikes due to sensors malfunctioning;

- Level of radiation that is significant: Higher than the threshold AND sustained, and how long “sustained” is;

- Exogenous causes such as geography. Readings in Colorado are always higher due to the higher elevation,

The website is basic but functional. There are Radiation Network maps of Europe, Japan, and the US (broken out for Alaska and Hawaii), and a message. The message is a running log of updates.